Written by Grant Ralph

Question1: What keeps the full nodes in line?

Do full node operators have too much power in the Bitcoin system? If they are the custodians of Bitcoin’s ledger, what stops a smaller group of nodes from, for example, disregarding the difficulty adjustment rule or from ignoring the predetermined issuance schedule?

The answer is ‘nothing’! Bitcoin is open-source software so anyone can at any stage change the software and release it for others to use with them. However, what’s important is that it doesn’t actually matter if anyone does this. Here’s why.

Remember the important principles

To understand what the disincentives are, it’s worth repeating certain key principles.

The first such principle is that bitcoin is money and a money only gets you something if others accept it from you in exchange for their goods, services or another money that they have. It is therefore in anyone’s best interest to converge with what others think, rather than create and use something that others don’t value.

Secondly, people value a money because it is able to be durable, portable, fungible, verifiable, divisible, scarce, has established history and can resist censorship.

In the next section I’ll use practical examples to: (i) illustrate these principles; and (ii) explain how and why Bitcoin full node operators are incentivized to stay in line.

Full node operators are economically incentivised to enforce the established consensus rules

Let’s assume for a moment that a group of nodes start developing and maintaining a new ledger that includes a miner reward in each block that is more than is provided for in Bitcoin’s predetermined issuance schedule. Better still, let’s assume the ledger has a miner reward that is less than the miner reward in Bitcoin. This lesser reward would in theory make this ledger’s native currency scarcer than bitcoin, right? At face value, yes, but actually not. Let me explain.

Despite this ledger having fewer units in circulation (a ‘scarcer’ supply), the break from the established consensus in Bitcoin requires us to ask some important questions:

- Will this new issuance schedule stay this way in the future? It has changed once so why won’t it change again? The mere fact that there has been a change (no matter how big or small) from the predetermined issuance schedule (established consensus) implies that there could be further changes to this new ledger’s rules at any stage in the future. By way of example, it’s now conceivable that there will be other decisions to radically increase the reward (which would dilute the value of the existing supply and impact scarcity).

- Is this new network going to treat all users equally, or will it favour the people who created it?

- Given the uncertainty raised in the bullets above, will this network get enough support in the form of full node operators? If not, will the network be able to resist any attempts to censor transactions in the network and what would stop anyone from seizing or confiscating the ledger’s currency from the owners/users.

These are just some of the questions that become important when people create a new ledger with its own native currency.

In summary, we now can’t with any degree of certainty predict the future for this new ledger and its own native currency and there is no guarantee that our property rights will be enforced. In these circumstances, it would be ill advised to use this ledger’s native currency to store wealth.

Don’t get me wrong, the creators are still free to use this new ledger going forward. All I wish to point out is that for the reasons explained above, very few, if any, other users will follow which means that the ledger’s native currency won’t be as valuable (have as much purchasing power) as bitcoin.

Bitcoin full node operators are therefore better served if they stay in sync and enforce the Bitcoin consensus rules along with the other nodes. They are economically incentivised to do so.

Lessons from Bitcoin Cash and Libra

Here are a few examples of how these principles have played out in real life.

On 1 August 2017 at the time of the 478 559th Bitcoin block, certain full nodes adopted a different set of consensus rules that made their new blocks incompatible with the existing Bitcoin blocks. The main changes were to allow for an increased amount of transaction data to be included in each block and to remove segregated witness from the code. Without going into the detail, their thinking was that these changes would easily enable more transactions per unit of time and that this was required at that point of Bitcoin’s development as a money and peer-to-peer network.

Notwithstanding that a small number of full nodes adopted this change, the majority did not because they didn’t think that the changes were good for bitcoin’s monetary attributes. In particular, the majority of full node operators believed that having blocks with more data would make it harder for ordinary people to run a Bitcoin full node.

This was not an outcome that the majority of users wanted because their view is that Bitcoin needs a lot of people running full nodes in a lot of different places if it is going to remain decentralized. Only if Bitcoin is decentralized will the network be able to resist censorship, and will the native currency, bitcoin, have the important monetary attribute of censorship resistance.

Indeed, just recently we got some more evidence of the fact that if any money is going to take on governments, central banks and other custodians of the existing financial system then it ought to be able to resist censorship from these powerful institutions. These institutions have a lot to lose if an alternate to fiat money is fully monetized so it is at this point highly unlikely that they will hand over the reins without putting up a fight.

The recent censorship that I’m alluding to is the immense scrutiny and pressure that Libra has faced (Libra is a digital money proposed by Facebook through the Libra Association). If you haven’t been following along over the past 6 months, you can read articles here and here. Some of the more interesting quotes from the politicians around the world (also contained in the articles) are:

- “with all of these problems I have outlined, and given the company’s size and reach, it should be clear why we have serious concerns about your plans to establish a global digital currency that would challenge the U.S. dollar,” Maxine Waters, chairwoman of the US House Committee on Financial Services on 23 October 2019.

- “We believe that no private entity can claim monetary power, which is inherent to the sovereignty of Nations” A joint statement from France and Germany at the meeting of eurozone finance ministers in Helsinki on 13 September 2019.

Given the backlash, one could argue that there is no guarantee that Libra will ever launch.

What about Bitcoin Cash? Well, the majority of people simply don’t value this ledger’s native currency. At the time of writing, there is only about 4% as much wealth stored in bitcoin cash as there is wealth stored in bitcoin (as represented by the market capitalization of each currency). This is a serious decline for Bitcoin Cash, something which has an identical ledger to Bitcoin up until 1 August 2017.

Bitcoin cash’s poor performance as a store of value relative to bitcoin is clear evidence that node operators are economically incentivised to stay in sync and enforce the Bitcoin consensus rules along with the other nodes.

Question 2: Can miners sabotage Bitcoin?

Part 2 described how miners work to convert a batch of new transactions into a block that can be added to the Bitcoin ledger and it explains that they perform this work because they receive newly created bitcoin and transaction fees paid in bitcoin as a reward for doing so.

Given that miners can clear and settle transactions themselves by adding new blocks to the ledger, what stops a miner from working on two different blockchains, one version that pays someone and another version that effectively overturns that payment? Said differently, what stops a miner from ‘double spending’ their bitcoin?

Like most things in Bitcoin, the economic incentives encourage people to do one thing instead of another.

Double-spend attack

In the Bitcoin system, a particular miner’s likelihood of producing proof of work before any of the other miners do is equal to, on average, the percentage amount of computational power that the miner has in comparison to all of the computational power that is mining bitcoin at that moment in time.

Therefore, if the miner controls 1% of the computational power mining bitcoin at that moment then he/she has on average a 1% chance of being the person that owns the computer that produces the proof of work before anyone else in that 10-minute window.

There is however a chance that the miner can get lucky and produce a few consecutive valid proofs of work in a short amount of time.

Simulation of a double-spend attack

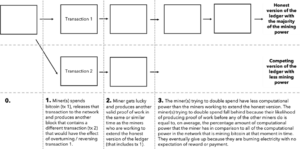

If we simulate a double-spend attack, it would develop as follows. Miner has spent bitcoin (“transaction 1”), released that transaction to the network and has now produced another block that contains a different transaction (“transaction 2”) that in effect overturns transaction 1.

The problem for the miner trying to double spend with transaction 2 is that all of the other miners will at the same time be working to extend the ledger that includes transaction 1. Remember that due to their ability to receive newly ‘minted’ bitcoin and transaction fees paid in bitcoin, other miners are at all times incentivised to produce proof of work that has the effect of converting a batch of new transactions into a block that can be added to the Bitcoin ledger.

So, the miner trying to double spend will have to get lucky continuously in order to be able to extend this second version of the ledger at the same speed as all of the other miners would be extending the version that includes transaction 1.

Due to the fact that there will be significantly more computing power working to extend the version of the ledger that includes transaction 1, over a sufficient period of time, much like the law of gravity, the law of averages will take effect and this version of the ledger will become longer (have more transaction history) than the version that includes transaction 2.

Full nodes will eventually completely ignore the shorter version of the ledger that includes transaction 2 because, as explained in this article, they are economically incentivised to ensure that bitcoin remains good money and that only valid transactions are cleared and settled.

For these reasons, when selling valuable goods for payment in bitcoin it is advisable to wait for 4-6 block to be built on top of the block that contains your transaction because after that period of time it becomes less and less likely (and eventually almost impossible) for someone to successfully double spend (by reorganizing the blockchain).

Bitcoin needs more than 50% of miners to mine honestly

As described above, the chances of a single miner, or even a smaller group of miners, being successful with a double spend in the short term is equal to the amount of computational power that they control in relation to all of the computational power in the system at that moment in time. However, due to the amount of proof of work that would need to be redone and caught up, even with more than 50% of the computational power a miner has little to no chance of being successful with an attempt to double spend bitcoin from a transaction that was spent in a block much further back in the chain.

While it is possible in the short term, so long as more than 50% of all mining power is working to extend an honest version of the ledger, then any other version will eventually fall behind (have less transaction history) and become insignificant in the system.

Since the probabilities do not favour a successful double spend; all miners are economically incentivised to direct their efforts towards producing proof of work for valid blocks that contain valid transactions. Only if they do this is there a chance that they will be rewarded the newly created bitcoin and transaction fees paid in bitcoin in the version of the ledger that continues into the future.

This is important because only if the miner’s reward and transaction fees are written into a ledger that continues into the future, will the miner have rights to bitcoin that other people value. Only then will the miner be able to cover its operational costs (including electricity) or make a profit.

Miners wouldn’t want to ‘shoot themselves in the foot’

In addition, if for argument’s sake a group of miners were to succeed with a double spend attack these miners would in effect be harming themselves more than they would be scoring. This is because a successful double spend would bring into question the Bitcoin system and the native currency, bitcoin, would probably no longer be valued by society. Less demand for bitcoin would reduce bitcoin’s purchasing power which in turn would have the effect of destroying miner wealth saved/held in bitcoin, and it would also make their application specific mining equipment worthless.

As a result of these economic incentives and the fact that people will want to create rather than destruct wealth, we can expect that the majority of miners will continue to mine correctly. This will, in turn, contribute to ensuring that the Bitcoin system continues to operate as it is meant to.

Closing

I hope that this article helps everyone think about the economic incentives that make Bitcoin work.

I for one can’t trust Bitcoin only on the basis that it uses math and software and I doubt that many others will be able to trust Bitcoin on this basis alone either.

Rather, I trust that we are all united by our desire to create rather than destruct wealth and that this universal human preference will see to it that the majority of network participants will do certain things instead of others.

This is why Bitcoin works.

Acknowledgements

If you would like a deeper dive into how Bitcoin works ‘under the hood’, the book “Grokking Bitcoin” by Kalle Rosenbaum is a brilliant resource. In particular, the book will help you learn about cryptography and how this technology is used in Bitcoin. I have not dealt with these aspects in great detail in this article so if you want to go further down the rabbit hole / are looking to take your understanding to the next level then this is the book for you to read and study.

Disclaimer: The comments, views, opinions and any forecasts of future events reflect the opinion of the quoted author, do not necessarily reflect the views of his employers or other professionals working for the same employers, are not guarantees of future events or results and are not intended to provide financial planning, investment or legal advice.

- Articles